MicroBT WhatsMiner M50, M50S, and M53 ASICs: Full Review – Features, Profit, and Payback

On April 6, 2022, the innovative ASIC MicroBT WhatsMiner M50S, M50, and M53 were unveiled at the Bitcoin 2022 conference in Miami, USA. This occurred on Industry Day. The devices are both energy efficient and have a high hashrate. Liquid cooling is also used by the Whatsminer M53.

The M50 and M50S are built in the conventional MicroBT style, with an extended casing and top-mounted power supplies. Two strong fans keep the room cool.

The M53 ASIC appears to be a flat box with only the bare minimum of outputs. Samsung 5 nm chips are used in all of the products. They are around 15% more efficient than the M30 series before them.

MicroBT WhatsMiner M50 Review

The new miners drew consumers’ attention first and mainly because of their technical capabilities. It will be able to produce and export 30,000 units every month, according to the company.

Whatsminer M50S Standards

The following are the claimed characteristics of the Whatsminer M50S, which may change significantly from the actual ones, particularly in terms of hashrate and power consumption. Typically, the first value is slightly lower, whereas the second value is slightly higher:

Hashrate — 126 Th/s

Power consumption — 3 276 W

Energy efficiency — 26 J/TH

Availability date — Q3 2022

Profitability of Whatsminer M50S

Using the manufacturer’s specifications as a starting point, the Bitcoin network’s complexity as of 04.06.2022, the exchange rate of BTC = 45,000 USD, and the cost of electricity = 0.04 USD per 1 kWh, we can estimate the profit the new M50S ASIC will generate:

– 22 USD per day;

– 660 per month;

– 7,920 per year.

Whatsminer M50S Payback

The retail price of the new ASIC has been estimated at 10,924 USD so far, ignoring logistics and shipping to each individual region. With the miner’s reported characteristics, the payback period is 1.4 years, allowing for a net profit before the next bitcoin halving.

Specifications of Whatsminer M50

The M50 Whatsminer has somewhat lesser specifications than the S-version. They’re also likely to differ significantly from the real thing, but here’s what the maker has said thus far:

Hashrate – 114 Th/s;

Power consumption – 3 306 W;

Energy efficiency – 29 J/TH.

Availability date – Q3 2022.

Profitability of Whatsminer M50

Let’s use the same Bitcoin network complexity as on 06.04.2022, with a BTC exchange rate of 45 000 USD and a power cost of 0.04 USD per 1 kWh. In this situation, M50 will earn as follows:

– 20 USD per day;

– 600 per month;

– 7,200 per year.

Whatsminer M50 retaliation

The retail price of this ASIC has not yet been disclosed, but it is now $8,857 USD on official dealer websites, excluding logistics and delivery expenses to each unique location. As a result, the miner’s payback duration is 1.23 years with the specified features. It is feasible to reach repayment before bitcoin halving and continue mining with earnings, depending on the availability date.

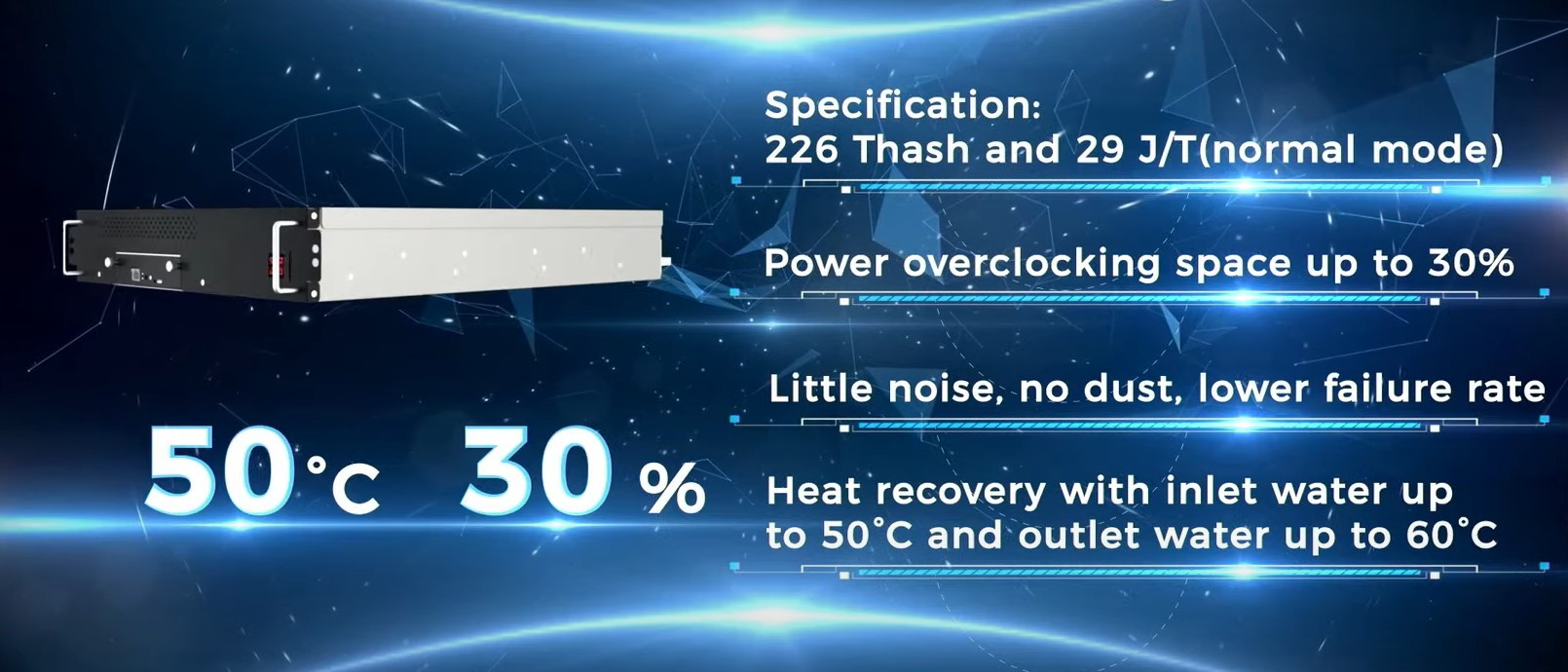

Specifications of Whatsminer M53

In terms of aesthetics and power stats, the M53 Whatsminer is without a question the most intriguing. Water cooling has a number of advantages, including the ability to use processors that are far more efficient, as seen by the device’s specifications. The water at the discharge has a temperature of 60 degrees Celsius:

Hashrate – 226 Th/s;

Power consumption – 6,554 W;

Energy efficiency – 29 J/TH;

Availability date – Q3 2022.

Whatsminer M53’s Profitability

Let’s use the Bitcoin network complexity as of 06.04.2022, an exchange rate of BTC = 45 000 USD, and a cost of electricity of $0.04 USD per 1 kWh for our calculations. In this situation, M53 will result in a profit of:

– 40 USD per day;

– 1 200 per month;

– 14,400 per year.

Whatsminer M53’s retaliation

Given that this ASIC will be the most powerful in the line, its price will almost certainly not be less than $15,000 USD, minus logistics and shipping to each specific region. With the mentioned characteristics, the miner’s payback period is little more than a year.

The WhatsMiner M50 series features the most advanced heat dissipation architecture in the series’ history. This allows the system to work at a higher level for longer periods of time, allowing MicroBT to maintain it in service for far longer than its competitors. Remember that the average repair rate for the WhatsMiner M20 series was 2.59 percent, while the WhatsMiner M30 series was only 1.66 percent.