The Value of ASICs Miners & Time fluctuation

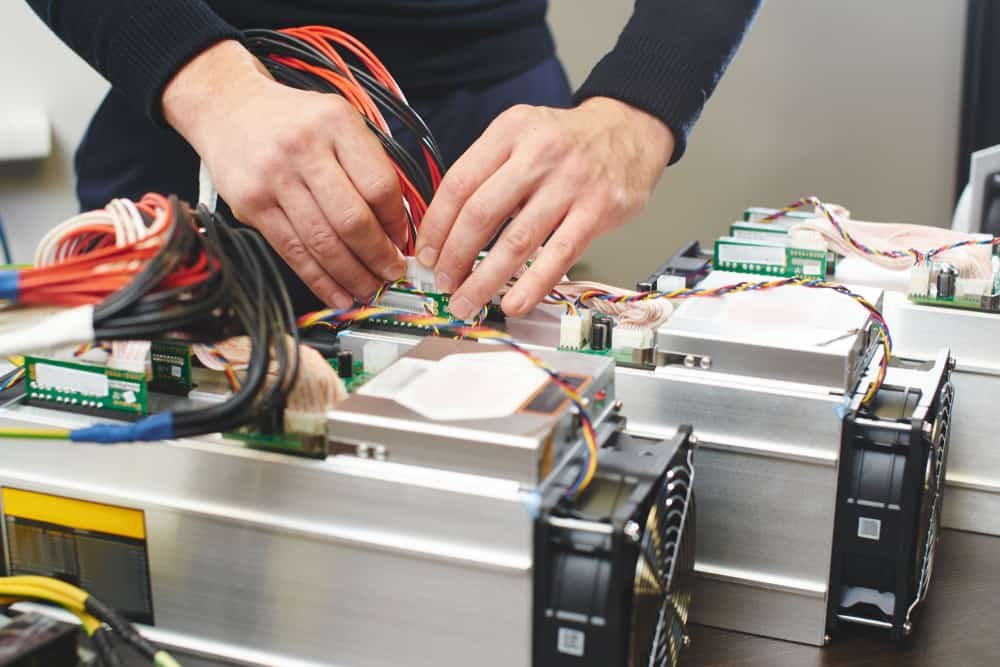

ASIC miners, like any other asset, are bought and sold in a marketplace. An ASIC miner’s price responds nearly instantly to the same supply and demand relationship that all other assets of value and use do. However, there are a few more distinct factors that influence the market price of an ASIC at any particular time.

The following factors affect the value of an ASIC miner over time:

1.) New ASIC Miners are in stock and ready to ship at any time, or they can be purchased on the aftermarket.

2.) The current price of the underlying Cryptocurrency, the cost of the buyer’s electricity, the current network difficulty to earn a block reward, and the present and future outlook of the crypto mining sector all influence the demand for ASIC miners.

The Impact of Cryptocurrency Prices and Network Difficulty on ASIC Miner Value

A “block reward” is the payout for proof of work (POW) mining, which is a cryptographic proof in which one party confirms to the other that a specified amount of computational effort has been performed. The revenue made by Bitcoin miners is just the number of Bitcoins awarded multiplied by the current Bitcoin price.

A network difficulty adjustment in Bitcoin’s protocol ensures that a block is awarded roughly every 10 minutes. As mining grows more successful, market forces will draw more hash power into the system, and the Bitcoin protocol will gradually increase the difficulty level of receiving a block reward. As a result, the performance of an ASIC miner has a significant impact on the machine’s current market price.

The value of ASIC miners is being pushed down by network difficulty. In order to make a credible approximation on the value of the machine today, the market participant evaluating the worth of a miner at any given time will need to assess the current and future rise in network difficulty.

A Look at the Profitability of ASIC Miners in More Depth

Let’s take a look at a simple thought experiment involving a possible ASIC customer at any given time. Here are some of the questions that may be on their minds:

- Is my cost of electricity going to increase?

- Is my cost of operations going to increase?

- Is the network difficulty going to increase?

- Is the price of Bitcoin going up?

All of these considerations play a role in determining whether or not an ASIC mining machine should be purchased. However, there is a disadvantage to focusing just on expenditures in the thought experiment. Some older, less efficient ASICs may see appreciation if specific supply and demand circumstances are satisfied, such as a limited supply of premium ASICs.

If you own or have custody of earlier models that are presently in high demand, you may be able to sell them for a higher price. An older model that has served your purposes for some time could be sold at, near, or even more than what you paid for it if you time it well. In other words, the return on investment would be significantly increased.

Where Can I Purchase an ASIC Miner?

If the results of your thought experiment drive you to consider purchasing an ASIC miner, there are a plethora of aftermarket solutions available online. For example, Compass Mining is a major and well-known company that provides a low-maintenance, all-encompassing suite of services as well as an open marketplace for new and used ASIC miners.

Buying from a third-party seller or secondhand, on the other hand, comes with its own set of hazards, one of which is the difficulty in ensuring that what is received is exactly what was intended. Another issue to consider is how your ASIC is handled and maintained when it is hosted by a third-party vendor.

If you’re looking to purchase a new ASIC miner, keep in mind that purchasing directly from the manufacturer may be difficult, as machines are in high demand and are typically sold to large, institutional customers first. Only a few enterprise-scale vendors of new ASIC miners are in continuous operation, so if you want to purchase the latest and most cutting-edge ASIC mining equipment at scale and at the greatest price, you’ll need to consider relationships.

Alternatives to Purchasing in an ASIC Miner

If your profitability evaluation is not in line with your expectations after working through this thought exercise, there are alternatives to investing in ASIC mining devices.

Bitcoin mining has evolved as an industry, and investors may now purchase shares in Bitcoin mining businesses in a straightforward and convenient manner. There are publicly traded firms such as Argo Blockchain, Riot Blockchain, and Marathon Digital Holdings if you want to buy shares in a cryptocurrency mining company.

Purchasing shares in a cryptocurrency mining company allows you to gain exposure to the cryptocurrency mining industry without incurring the direct costs of running your own mining operation, monitoring ASIC miner prices, or being subject to the macroeconomic and sociopolitical developments of this nascent industry.